In spring 2022, the prospects for new residential construction in Germany have clouded over massively. The turnaround in interest rates, the renewed surge in construction costs and the realignment of federal subsidies often mean that financing is no longer possible. Under these conditions, the market turnaround was inevitable. Nevertheless, it took almost a year before more precise estimates – as opposed to mere speculation – of the medium-term market correction became possible on the basis of official permission numbers.

Prices for housing construction services have increased by a total of a quarter in the past two years. In addition, interest rates for new housing loans in Germany climbed from 1.4% to 3.6% in 2022 (fixed interest rates over 10 years). And last but not least, the German government decided in 2022 to focus very strongly on promoting energy-efficient renovations in the future and is only allocating around 1 billion euros per year to the new construction sector. Unfortunately, these are not the only problems that have plagued clients, investors and construction companies for years. There is, for example, a shortage of building land (and a sharp rise in its price) and skilled workers, excessive bureaucracy and regulation, including ever stricter cost-driving energetic building requirements. So far, the sector has somehow managed to hold its own and come to terms with the numerous obstacles. But now the housing boom that began in 2009/10 is about to come to an end, even before housing supply and demand have been brought into balance in many places.

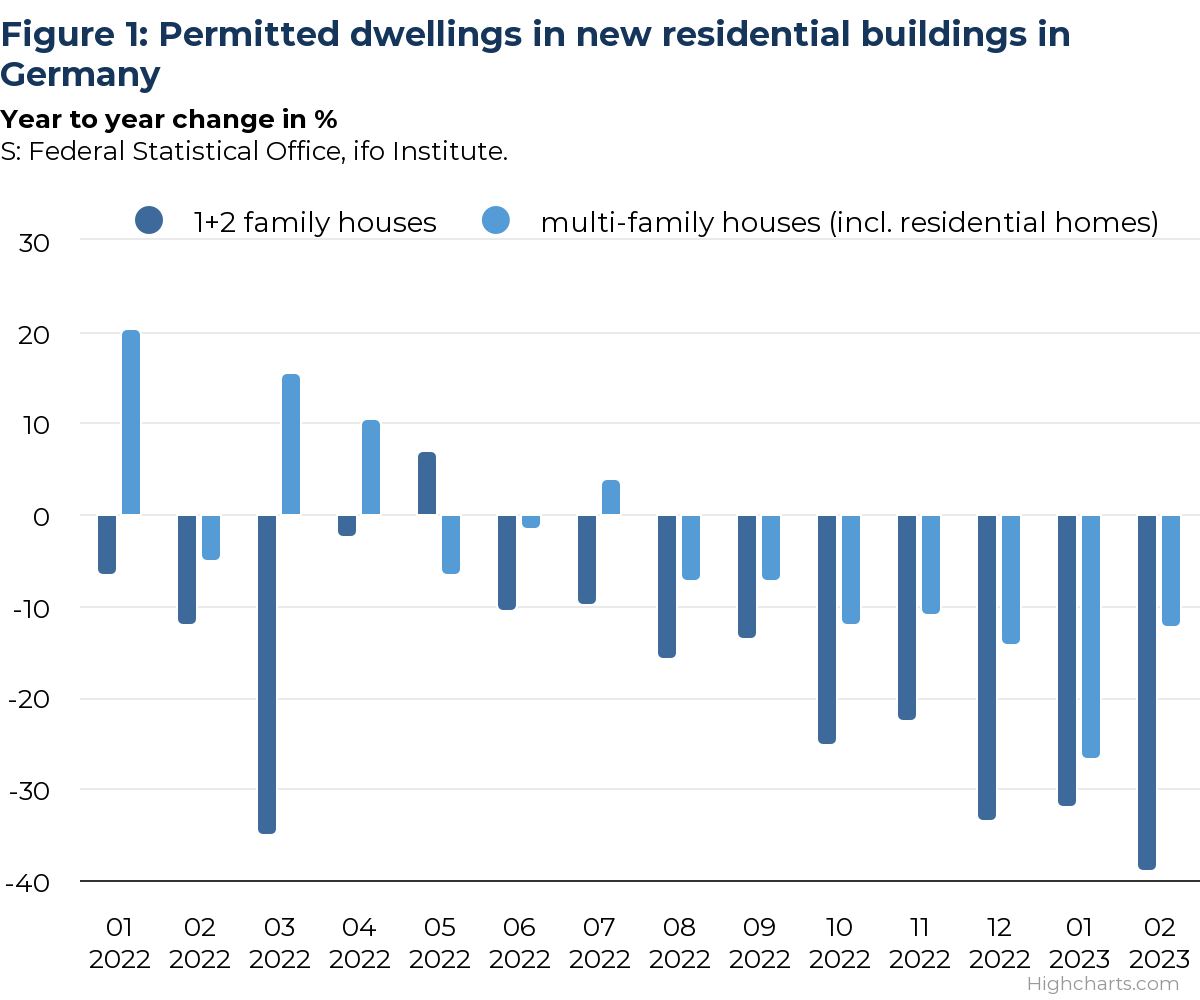

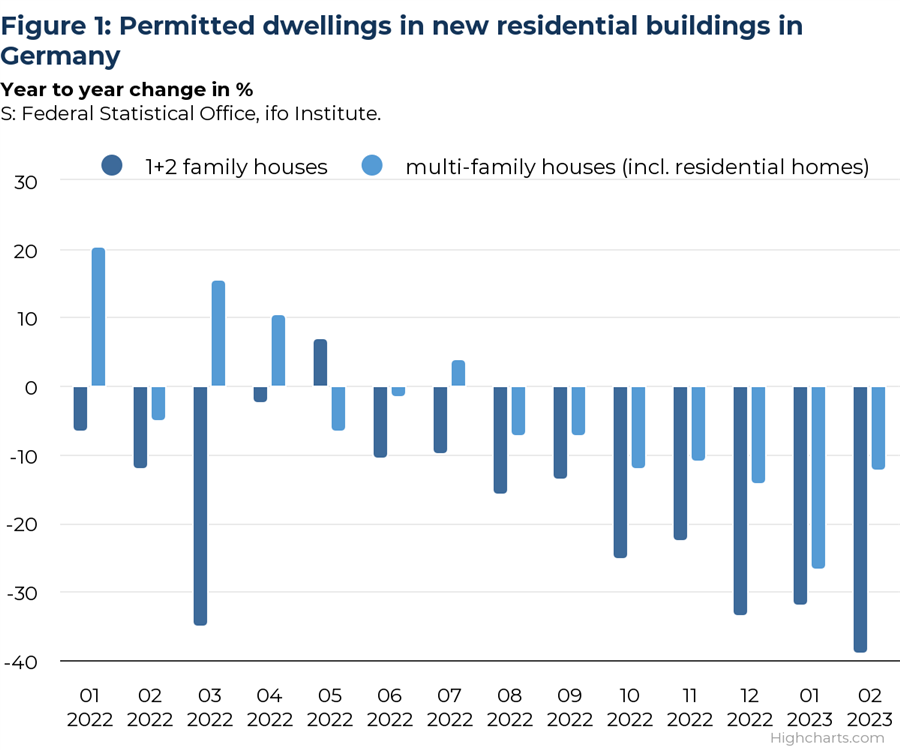

The look at the monthly figures for building permits initially did not reveal any conspicuous features that can be traced back to the changed framework conditions (cf. fig.). A certain up and down compared to the respective month of the previous year is the order of the day. In addition, the considerable decline in single- and two-family buildings in March 2022 could be explained by the much stronger increase in the year before. In March 2021, the application deadline (referred to the month of the building permit) for a subsidy measure specifically targeted at households with children expired. Arithmetically, it was still not clear until August/September 2022 whether the declining monthly values were due to the usual compensation of pull-forward effects or already to the changed market environment. And also in multi-family house construction, new building projects temporarily were applied for earlier due to tighter funding requirements.

With the monthly values from October 2022 (publication date: mid-December 2022), a clear decline in construction demand was now becoming apparent. Up to this point, the lengthy administrative procedures regarding building applications probably played an important role. Many of the construction projects that were applied for in the course of 2022 were probably not even started because the clients wanted to wait in view of the many challenges posed by the Ukraine war and the funding cuts. In this respect, the approval figures available for 2022 probably significantly overstate the amount of newly initiated projects.

In the first two months of 2023, the shown development of the rates of change is now inconsistent between the two building types. However, this is again likely to have to do with the approval activity in the previous year. Apart from that, on the basis of the more recent values, only around 75,000 dwellings in new single- and two-family buildings (2022: 106,000 units) could be approved in 2023. A continuing slight downward trend is probable, especially in light of the renewed strong construction price increase in the first quarter of this year. The industry, and above all the finishing trade, is still living off the orders still to be processed so the completion figures will only react with a significant delay. Nevertheless, a figure of only 65,000 completions would be conceivable for 2025 (about 20,000 units below the all-German low). The big unknown here is: what has actually been started or for how long has it been it been interrupted? Is the construction period shortening again somewhat because of the lower demand/reduced utilisation?

For multi-family buildings (including residential homes), the drop height is much greater. At the worst times, only about 53,000 flats were completed. In 2022, there will probably have been around three times as many. The fact that many cities are encouraging their municipal housing companies to continue their activities even under the new conditions and, if necessary, are providing impetus with targeted financial injections, special subsidies and heavily discounted land costs may speak against an all too sharp drop. Individual federal states have also responded with better funding conditions for social housing construction. Nevertheless, most private and cooperative actors currently do not see themselves in a position to carry out new projects, because the required rents and purchase prices could not be obtained on the market. In view of the current approval figures, a big decline down to 145,000 permits in 2023 does not seem unrealistic. With the probably significantly lower realisation rate, this could mean for 2025 that maybe 110,000 completions in multi-family buildings would still be reported. In the same scenario, the 100,000 mark could even be undershot in 2026. A major problem is that not only significantly fewer projects are physically started, but also that considerably fewer projects are initiated or prepared because of the gloomy conditions. This will push down the number of permits in later years.

Together with the possibly likewise declining figures in the area of other completions (dwellings in existing buildings and in new non-residential buildings), the number of projects could actually drop within the period 2022-25 by one-third to only around 200,000 housing completions. The resulting pressure on specialised construction companies to adapt (including staff reductions) is likely to be considerable. Actually, the federal government has set itself the goal of building 100,000 more housing units per year (namely 400,000). Unfortunately, its decisions are currently contributing to 100,000 fewer being built.

Texten är skriven av Ludvig Dorffmeister, expert på den tyska bygg- och fastighetsmarknaden vid IFO Institute. IFO Institute ingår tillsammans med Prognoscentret i det europeiska analysnätverket Euroconstruct som tar fram prognoser för nitton europeiska bygg- och anläggningsmarknader två gånger per år. Kontakta oss för mer information om Euroconstructs prognoser och rapporter.